KEY TAKEAWAYS

- Plastic credits transform waste management into a profitable venture by rewarding organizations that collect or recycle plastic waste and enabling producers to offset their footprints through credit purchases.

- Multiple globally recognized bodies (e.g., Verra’s Plastic Credit Standard, Plastic Bank, PCX, GPP) employ differing verification criteria, leading to a lack of a universally accepted standard.

- Implementing plastic credit in Nigeria will bridge the financing gap and encourage plastic collection systems that were otherwise not economical.

- Transparency, universally accepted standards, and rigorous verification by third-party organisations are essential for the success of the plastic credit system and the reduction of greenwashing.

INTRODUCTION

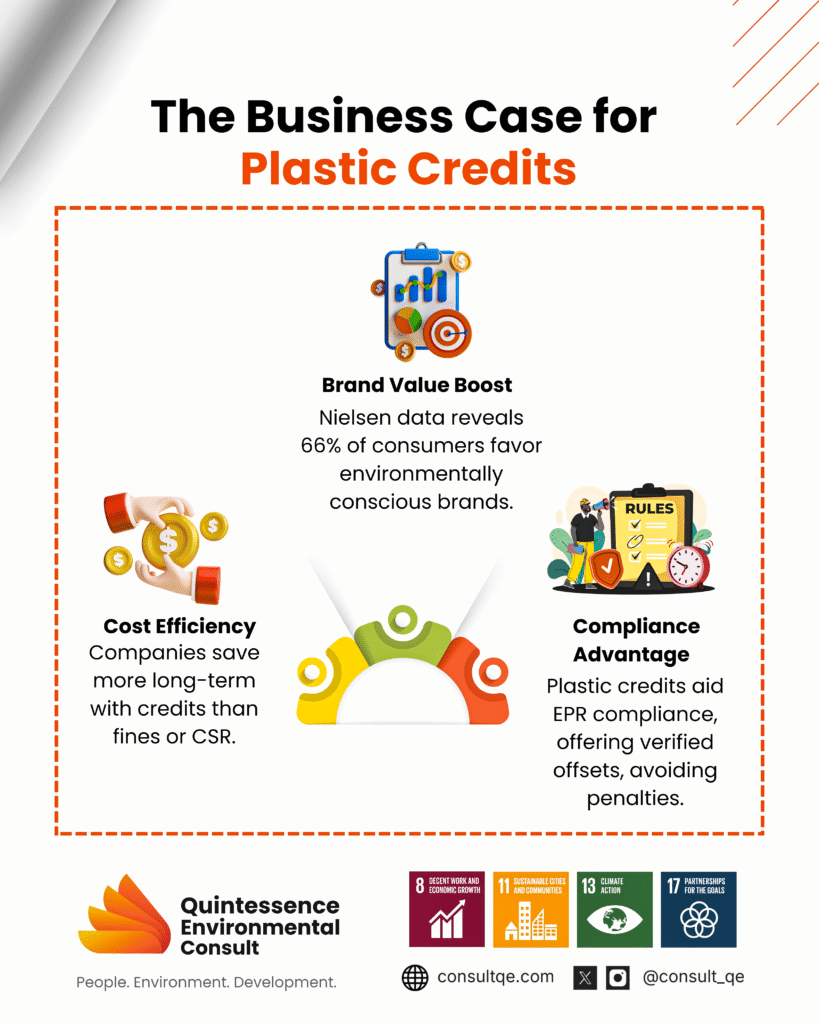

According to the world-bank, it is estimated that USD 1.64 trillion of investment will be required by 2040 to tackle pollution[1]. To meet this financial requirement, waste management must be made profitable. Plastic credit is an auditable, tradable, transferable certificate that represents a unit of plastic reduction. The credits are typically earned by organizations that collect and recycle plastic waste, and are bought by organizations that produce or consume plastic to offset their plastic footprint. The revenue made by selling the credit is then used to support plastic waste management programs, resulting in further credit generation. This way, the plastic credit incentivizes waste management by ‘penalizing’ plastic production and consumption while ‘rewarding’ plastic waste prevention.

Plastic waste management is a capital-intensive program. In many developing countries, the cost of solid waste management can be as 50% of the total municipal budget [2]. Therefore, there is a need to incentivize plastic waste management by making it sustainable and scalable. The plastic credit system is one innovative way of injecting funds into the waste management program in a sustainable manner. Overall, this acts as an extended producer responsibility (EPR)scheme that will make plastic waste management economically viable and scalable.

HOW TO EARN AND TRADE PLASTIC CREDIT

All programs and investments that lead to a reduction in plastic pollution typically earn plastic credit after verification and certification by a third-party organization. These include upstream measures aimed at preventing and reducing plastic waste generation and downstream measures such as waste collection and recycling. The credits are issued for specific quantities of plastic waste removed or prevented from entering the environment above a recognized baseline. The baseline refers to the original waste prevention, collection or recycling capability of an organization. This scheme leads to additionality, i.e a net and incremental reduction in plastic waste pollution. Typically, one credit unit equals one metric tonne of plastic waste managed (collected/recycled) beyond that baseline. According to world bank estimate, the value of the unit is 140- 670 USD, depending on the waste collection context and issuing organization[1]. Companies, governments, and individuals who produce or consume plastic can purchase these credits as a way to offset their plastic footprints.

CREDIT CERTIFICATION

Plastic credit is issued only for plastic collected or recycled above the baseline effort. To ensure transparency, waste reduction efforts must be independently verified by third-party organizations that would then issue a credit certificate. Some of these certification bodies enjoy global recognition, such as: The Plastic Bank, Verra’s Plastic Credit Standard, The Global Plastics Platform (GPP), BVRio, Plastic Credit Exchange (PCX), Zero Plastic Oceans (ZPO), etc [1,3]. These organizations employ different standards for verification and issuance of certificates. This is one of the major issues with the plastic credit since there is no uniformly accepted standard, and credit issued by one organization may not be recognized by a company that has not subscribed to that organization.

IMPLEMENTING PLASTIC CREDIT SCHEME IN NIGERIA

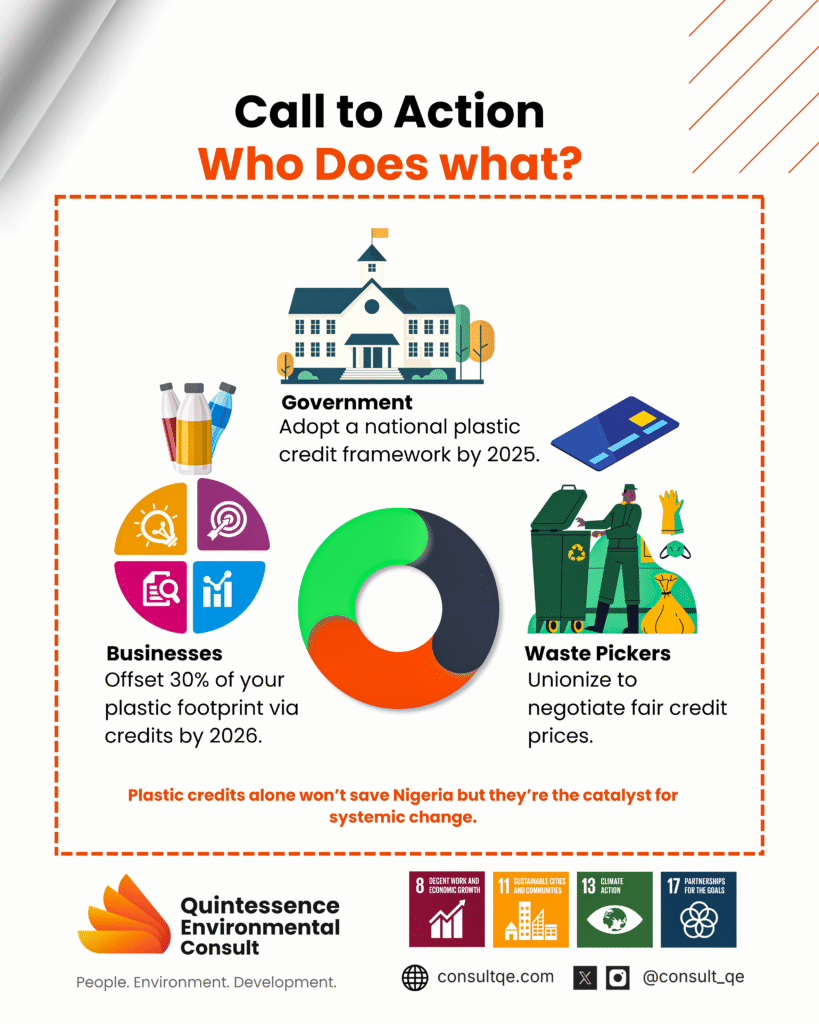

Plastic crediting can be used as a compliance mechanism within EPR schemes. Producers can purchase plastic credits to meet some of their obligations. If operationalized in Nigeria in a transparent, performance driven and structured manner, plastic credit can bridge the financing gap and encourage collection systems that were otherwise not economical. Setting up a plastic crediting system in Nigeria will involve several key steps, including understanding the regulatory environment, engaging stakeholders, creating a transparent tracking mechanism, and developing infrastructure for collection, recycling, and credit distribution.

CHALLENGES WITH PLASTIC CREDIT SYSTEMS

Not all plastic waste reduction or recycling projects are equally effective. Some may provide minimal environmental benefits, while others may lead to long-term improvements. One of the key challenges is ensuring that credits are issued only for projects that have a substantial impact. If credits are issued too loosely, without rigorous verification of net impact, the value of plastic credits could drop, undermining the financial incentive for the scheme. Additionally, relying too heavily on plastic credits as an offset mechanism might delay the necessary reduction in plastic production and consumption by companies and encourage greenwashing [1,3].

RECOMMENDATIONS FOR A SUCCESSFUL PLASTIC CREDIT SCHEME

Plastic credit should have a clear governance framework that involves external stakeholders from various sectors. The program should use relevant, consistent, universally accepted standards and definitions for measuring impact. The impact should not just pertain to the volume of plastic collected, but also to plastic types, its use, and end point. This is essential because removing one ton of plastic in one context is not the same as removing it in another. Double counting in different schemes or with existing EPR and tax systems should be avoided.

The value of Credits should reflect the cost of waste management rather than the material value. This includes the cost of waste management infrastructure and living wages for waste workers.

Credit sold to organizations should be transparently reported against the volumes of plastic materials put on the market by the buying companies. Such organization should demonstrate prove they have explored all available waste prevention options given their peculiar situation. These efforts should adhere to the principle of waste management hierarchy by prioritizing reuse and recycling before incineration and disposal of waste. This is essential to prevent organizations from using plastic credit for greenwashing.

CONCLUSION

Plastic credits are a market-based solution designed to address the global plastic waste crisis by incentivizing plastic waste management. The incentive is provided when plastic reduction efforts generate credit, which is then sold to businesses and individuals that produce or consume plastic to offset their plastic footprints. However, ensuring transparency, robust verification, and uniformity in standards is essential for the success of the plastic credit system.

REFERENCES

[1] The World Bank (2024): Product overview series for financial instrument: plastic credit at a glance. (http://www.worldbank.org/problue)

[2] M. G. H. W. Guerrero LA, “Solid waste management challenges for cities in developing countries,” Waste Manag, vol. 33, p. 220–232, 2013.

[3]GIZ (2022): Position paper on plastic credit(www.giz.de)